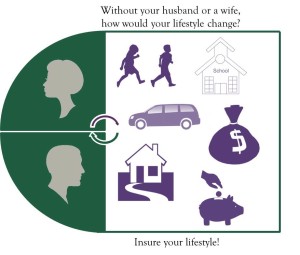

It is very easy to say that having $XXX,000.00 of life insurance would be enough in the event of a death to a husband or a wife. However, if you really think about the expenses incurred with keeping up the same lifestyle that you have now you might be in for a bit of a shock.

It is a well known fact that most families have expenses related to schooling, transportation, housing, savings, etc but the combined cost of each of these items are usually more than you expect. As an example, let’s briefly look at the cost of schooling. There are costs that go beyond basic things like tuition (if applicable) and supplies. Examples include playing sports (uniform, equipment, etc), purchasing the latest technology (ex. laptop or tablet), field trips, gifts for teachers, attending birthday parties for classmates, clothing, etc.

Schooling is just one example. Now think about the costs related to owning a vehicle, maintaining a home, grocery shopping, etc. Yes, it is easy to say it costs $XX,000 to buy a car or $XXX,000 to buy a home but all of the smaller costs of having these items can quickly add up. Add on top of these costs there is the fact that they usually aren’t one-time costs. These costs can hit multiple times throughout the year (some costs like groceries are probably weekly and other costs like utilities are monthly).

To have adequate life insurance coverage, we recommend the following simple formula:

(Purchase Cost x 25% maintenance or quality of life) + cost of living increase for 5 years (usually 3% year over year).

A simple example which only incorporates housing and a car valued at $230,000 might look like the following:

$230,000 for house and car +

$57,500 for maintenance/quality of life (25%)

$287,500 Total

$287,500 X 3% = $8625 cost of living increase per year

$8625 X 5 years = $43,125

TOTAL NEEDED: $330,625

In this scenario, would you have enough Life Insurance coverage? If you don’t have enough life insurance, you could simply increase your policy and ensure adequate coverage. However, if you don’t do this then how would the difference be made up and what would the impact be on the family? You certainly wouldn’t want to spend more time working and less time with your family to make up the difference. You also wouldn’t want to have the added stress of loosing a loved one and not having enough money to cover expenses (as the rest of your family will certainly pick up on this).

Insure your lifestyle today. Contact Employees Only for a free consultation on Life Insurance and ensure you have the proper coverage amount.

(click to view larger)

(click to view larger)

Leave a Reply